Previously I discussed the likely focus of the snap general election and what it may bring for the construction and infrastructure industry in the run-up to Brexit. Since then, matters have progressed to pave the way to the negotiations. On 22 May 2017, the EU27 in the General Affairs Council formally adopted the first set of negotiating directives and a decision giving the Commission ‘a mandate to start talks with the UK’, and Michel Barnier has earmarked 19 June 2017 as the official start date.

The hour of political skirmishes is thus nearing its end and formal structured negotiations will soon begin – just 11 days after the general election. In this context, stakeholders in the construction, infrastructure and energy sectors will no doubt be anticipating the general election results with intense interest, as the next government will have to steer the course of the negotiations and mould the terms of Brexit from scratch.

The manifestos and the polls

The major parties have now released their respective manifestos and although we have learned from recent experience that elections are capricious creatures, it is nonetheless a good idea to briefly consider where the parties stand on Brexit and industry-related issues.

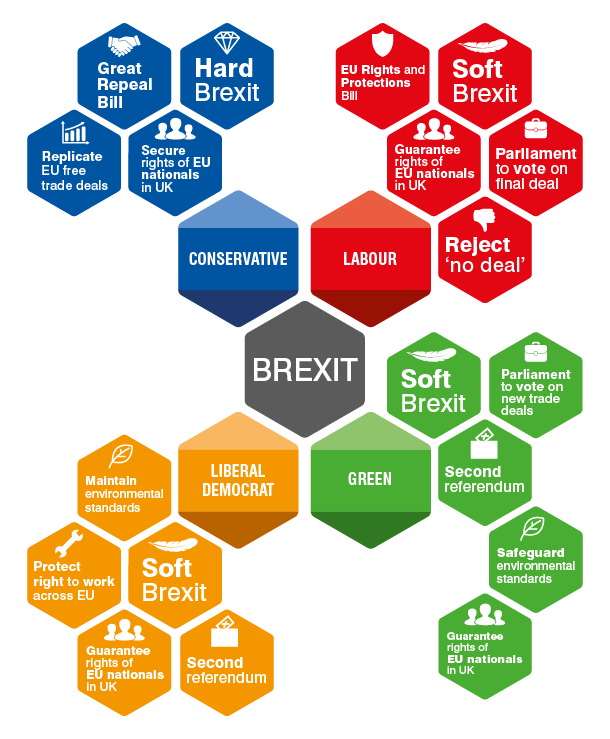

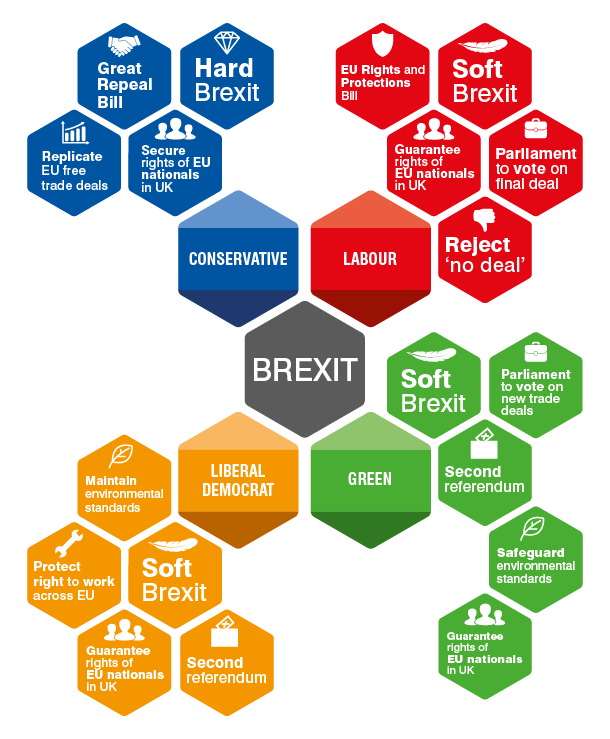

The infographic below summarises the key manifesto commitments of the Conservatives, Labour, Liberal Democrats and Greens, in relation to the Brexit negotiations:

Since the release of their manifesto, the Conservatives’ lead has been halved – at 43% (as at 22 May 2017 according to Survation), the Conservatives still enjoy a sizeable lead, but with the recent U-turn on social care policy added to the mix, Labour may well see a further surge in the polls. Of course, polls have been proven wrong more than once in recent election history, so it is difficult to second-guess the results.

Promises of major construction/infrastructure projects

To start with, the Conservatives and Labour promise a National Productivity Investment Fund and National Transformation Fund respectively, both of which aim at investing in construction and infrastructure. Labour, however, has conspicuously refused to commit a specific figure, whereas the Conservatives are prepared to commit £170 billion of investment.

Labour interestingly frames its fund as a ‘joined-up industrial and skills strategy that ensures a vibrant construction sector with a skilled workforce and rights at work’, but that is again lacking in specifics except for the express commitment to build 100,000 new council and housing association homes.

The Conservatives, on the other hand, promise to build 1.5 million new houses by 2022 and enter into new Council Housing Deals, spend £1.1 billion to improve local transport and infrastructure (in part to support the major new housing projects), and continue developing a strategic road network, High Speed 2, Northern Powerhouse Rail, and the expansion of Heathrow. There was no mention of Crossrail 2, which has caused concern among some in the industry, but if the rest of the manifesto commitments materialise, the industry would be kept stimulated at least in the short run leading up to Brexit.

Real risk of skills shortage

What the parties are not very strong on is the issue of immigration and skills shortage in the immediate future. Labour promises ‘fair rules and reasonable management of migration’ (which is somewhat vague), but immediately guarantees the rights of EU nationals already in the UK. The Conservatives also promise to secure the right of EU nationals in the UK, but that is likely to be subject to reciprocal treatment of UK nationals in the EU. As such, the fates of EU construction workers/professionals currently in the UK are still hung in the balance, and the effect can already be felt in the increasing departure of EU nationals from the UK (117,000 in 2016), which construction firms say are threatening the viability of major housing/infrastructure projects.

The industry is rightly concerned, especially since the Conservative manifesto promises to bring annual net migration to below 100,000 and double the Immigration Skills Charge levied on companies to £2,000 a year. It does propose an independent Migration Advisory Committee to ‘set aside significant numbers of visas for workers in strategically-important sectors… without adding to net migration as a whole’, but there is no specific mention of the construction industry.

The Economist warned that the intended immigration cuts could be highly damaging because ‘even if Britain banned all immigration from the EU–which would be ruinous–net migration would remain above 100,000’ (see graph compiled by the Economist), and in fact, ‘the current migration flow works in Britain’s favour’.

Way forward – campaigning and risk management

In these circumstances, the construction and infrastructure industries will have to:

- Make the issue of migrant construction workers a priority in the remainder of the election campaign and continuously after the election, in order to ensure that the next government will provide adequate channels and measures for construction tradespeople and professionals to continue coming to the UK from the EU and other countries, irrespective of its overall net migration target.

- Take into account risks associated with insufficient or fluctuating labour resources when tendering for a project and drafting contracts, so that this is factored into the tender price, programme, completion date, and liquidated damages clauses. Bespoke clauses can also be tabled e.g. by adding unforeseeable reductions in labour levels as a relevant event for an extension of time.

Stay tuned for the next issue of the Brexit Bulletin, which will revisit this topic and discuss some of the related legal challenges faced by the industry.

Mathias Cheung

Mathias’ practice covers all areas of Chambers’ work, including construction, engineering and infrastructure, energy and utilities, information technology, and professional negligence. In addition to these specialist areas, he has gained experience in a wide range of commercial disputes, including cases on fraud, insurance, assignment, subrogation, and conflicts of law. Mathias is also the winner of the SCL Hudson Prize 2015 for his essay entitled ‘Shylock’s Construction Law: the Brave New Life of Liquidated Damages?’.

As a native of Hong Kong, Mathias is fluent in both Cantonese and Mandarin, and he is therefore able to take instructions for cases involving Chinese-speaking parties and Chinese documentation in Hong Kong, Mainland China, Singapore and other jurisdictions.